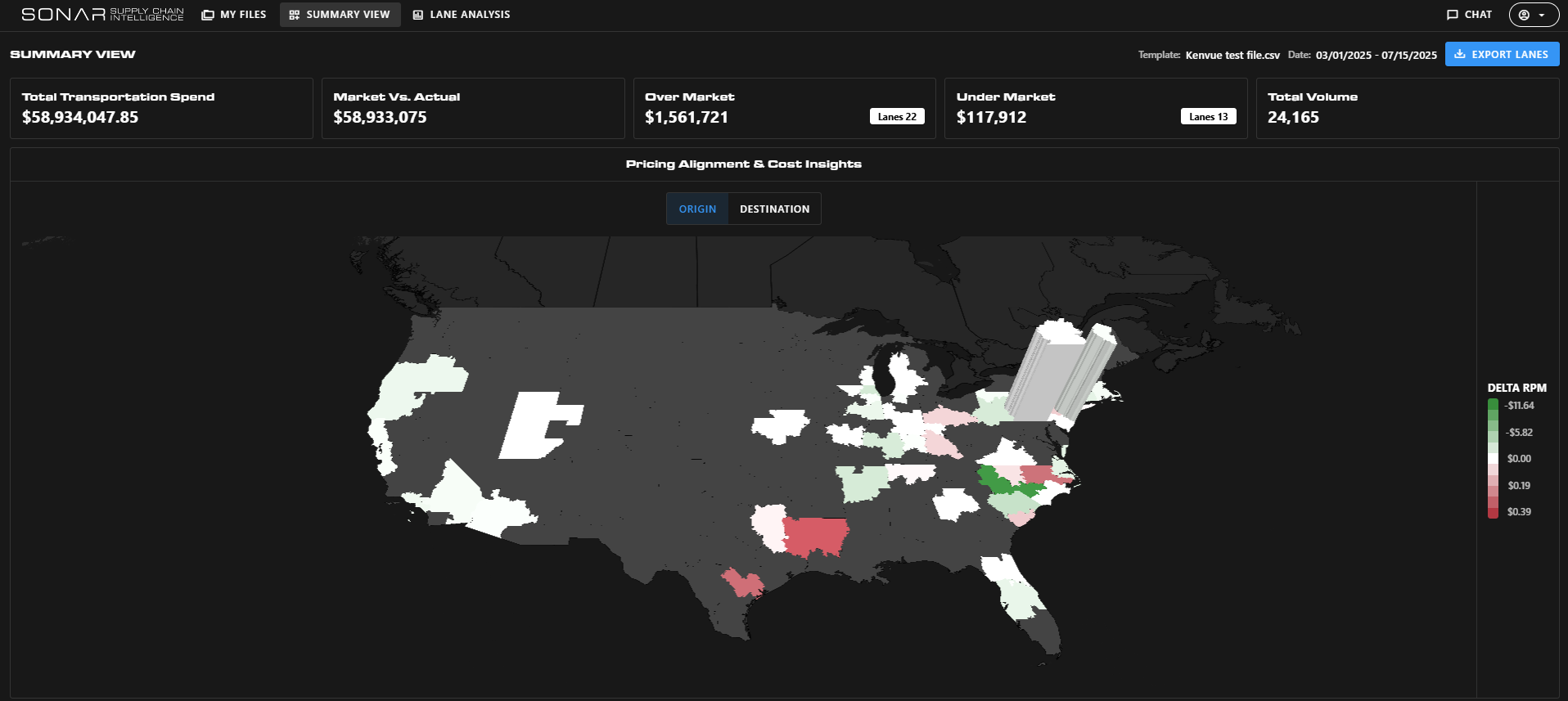

The Summary View is your landing page for every new analysis—offering a clear, high-level overview of your uploaded freight data, total transportation spend, and how your pricing stacks up against the market. This is your launchpad for identifying opportunities, assessing risk, and deciding where to dig in first.

This view surfaces the most actionable insights right away, helping you prioritize which lanes and markets need attention based on how your rates compare to the SONAR market rates.

Key Metrics in the Summary View

Pricing Alignment & Cost Insights Map

This interactive map allows you to visually scan your entire network for rate alignment issues:

Clicking any market on the map will take you directly to the Network View with those specific lanes selected—streamlining your workflow from insight to action.

The Summary View simplifies complexity into clarity offering a fast, actionable understanding of your freight network’s financial performance and areas for improvement. It’s the ideal place to start any analysis before exploring deeper lane or market views.