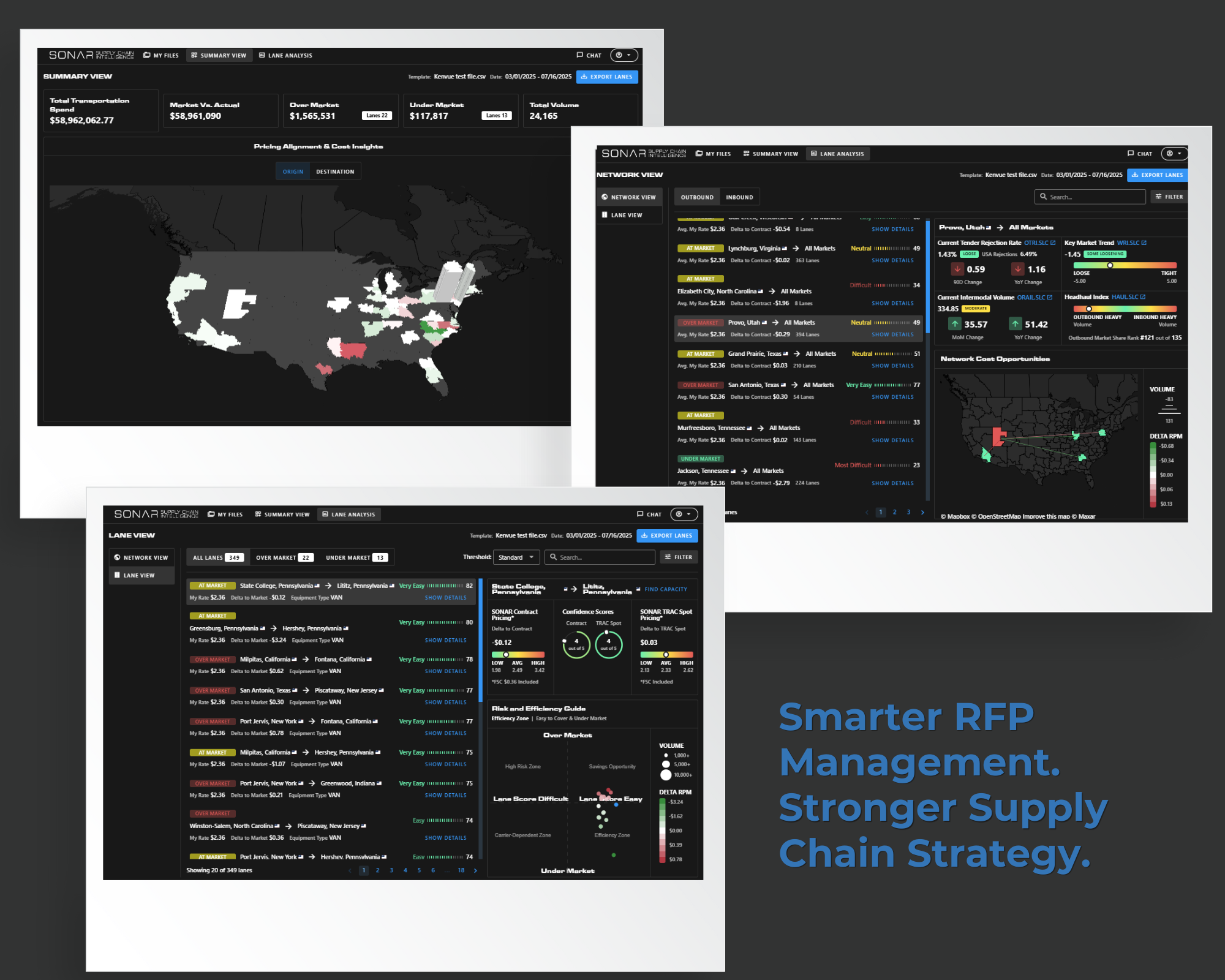

SCI is a dynamic freight analysis and strategy platform purpose-built for shippers who want to transform raw transportation data into actionable insight. By combining your lane-level rate and volume data with SONAR’s industry-leading market benchmarks, SCI helps you uncover hidden cost opportunities, evaluate compliance risk, and drive smarter procurement decisions—all within a unified, interactive workspace.

From high-level overviews to granular lane diagnostics, SCI allows you to understand your network like never before.

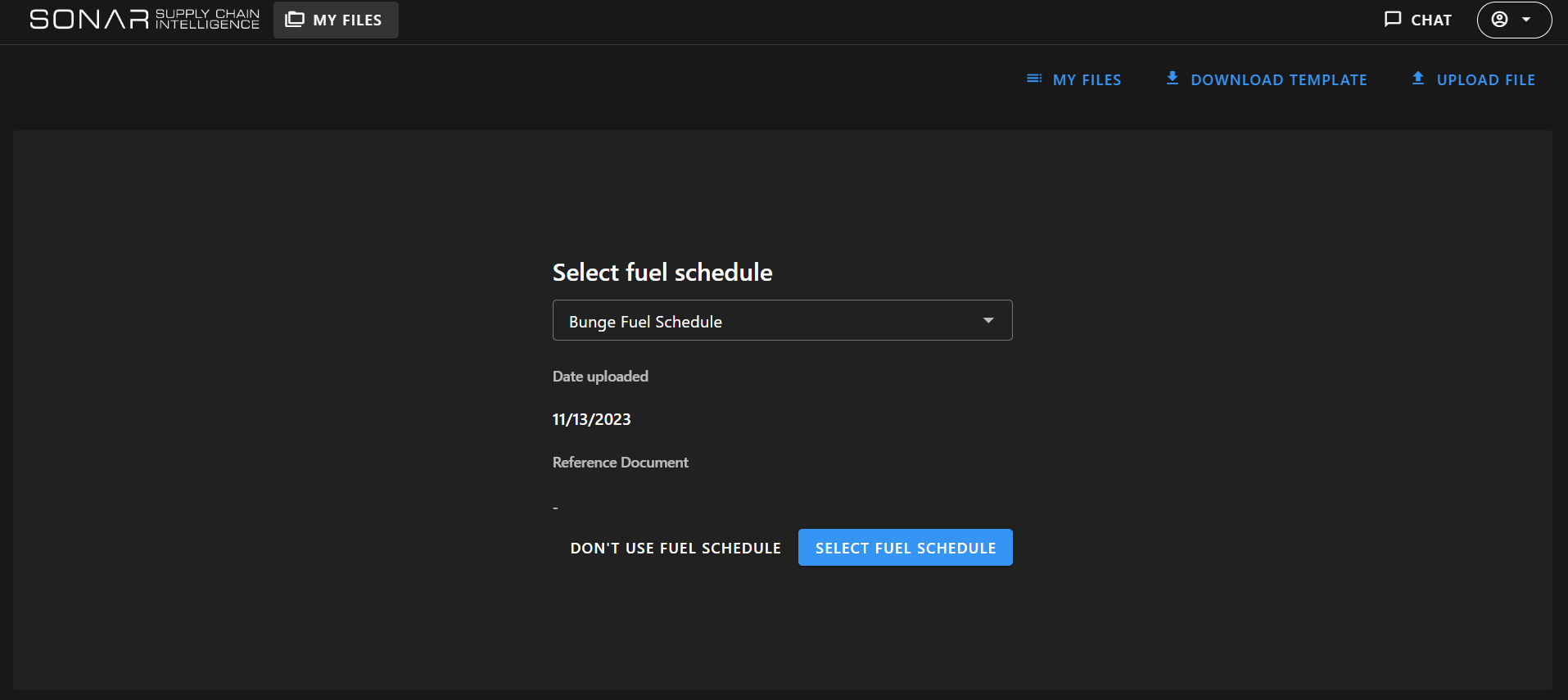

Fuel Schedules :

Fuel schedules are meant to provide users with the ability to incorporate custom fuel surcharges into their rates when doing a benchmark analysis of their lanes. If you choose to not use or upload a fuel schedule we will calculate the Fuel Surcharge based on this formula -> (DOE.USA – $1.20) / 6.5mpg = fuel_surcharge_rpm

Selecting a Fuel Schedule

SCI surfaces key insights at three levels of analysis—each designed to help you take strategic action:

Across all views, SCI helps answer:

In today’s fast-moving freight environment, relying on outdated assumptions or fragmented data can lead to costly mistakes. SCI empowers shippers with the clarity, confidence, and control needed to make smarter, faster decisions. By combining your internal data with real-time market benchmarks, SCI helps you proactively address inefficiencies, justify procurement strategies with data, strengthen carrier relationships through transparency, and build a more resilient and cost-effective supply chain. It turns reactive logistics into strategic advantage ensuring you stay ahead of the market.

SCI is designed for shippers who are actively involved in:

It’s especially powerful for:

The video below will give you a step by step tutorial on how to fill in the template for SCI.

For the full SCI 101 tutorial – coming soon.